WHY LATVIAN AND ESTONIAN TOP101 OF MOST VALUABLE COMPANIES IS DIFFERENT AND WHAT DO WE STILL HAVE IN COMMON WITH OUR NEIGHBORS?

KĀRLIS KRASTIŅŠ, PRUDENTIA MANAGING PARTNER

Needless to recall, how much Latvia and the whole world is tired of the Covid-19 pandemic. The recent announcements of effective vaccines give hope that this pandemic will end eventually. However, globally something has already changed irreversibly – the pandemic has stimulated revolutionary and fundamental changes.

Working in 2020 is a serious challenge for every company. For some it is a struggle for life and death. Formation of this TOP101 takes place under exceptional circumstances because we should be able to analyze approximately 700 annual reports in both countries in record-short time. Companies were allowed to submit them by the end of October. And due to Covid-19 we should pay triple attention to the annual report analysis to make no mistakes regarding long-term cash flow calculation.

In the analysis of the most valuable Latvian and Estonian TOP101 companies, the Covid-19 impact is reflected in two ways. Firstly, it is direct, according to the reaction of stock exchanges, because we use comparative industry data from the end of June this year. By then, many trillions of freely transferable funds in different currencies from central bank and government support activities had flowed into the exchanges and the economy as a whole. On the other hand, these latest annual reports are for 2019 – hence the individual performance of companies and the impact of the pandemic on them will only appear when creating TOP101 next year.

It also explains why such companies as Tallink, airBaltic or Infortar, where the core business is international passenger transport and hotel business – sectors that have suffered greatly and still suffer from the pandemic, are still ranked high in the top. In 2019, these companies were successful, and the annual reports reflect that as well. However, in 2020, these companies have received government support and continue to adapt to the crisis, but it is difficult to judge the development of the situation in the next few months.

The Quote by Rainis in the title adequately characterizes the work of Latvian and Estonian TOP101 companies during the pandemic. The pandemic has changed the world, and companies need to change as well. Many activities, services, products and processes are being digitized at a tremendous pace. Turns out that a great deal of products and services can be provided remotely.

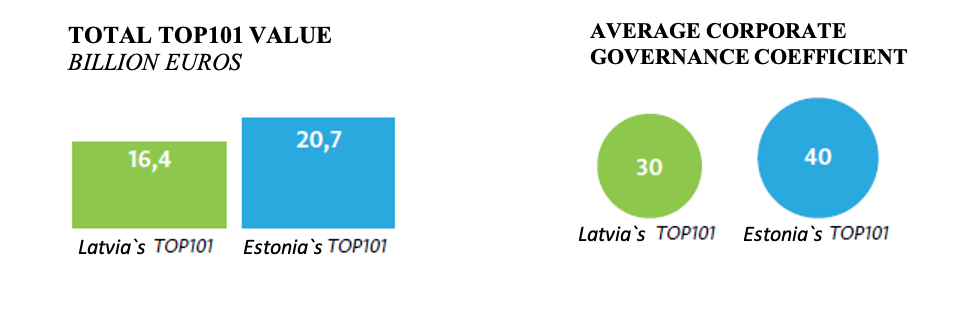

The total value of the Latvian TOP101 is 16.4 billion euros, 3.3% less than in the previous year. In Estonia – 20.7 billion euros, unchanged from the previous year. So, the overall value dynamics are very similar with no essential changes during the year.

In both countries, the first position is occupied by the electricity generation and trade companies – Latvenergo and Eesti Energia. Values for both of them are pretty similar, however different trends can be seen. The value of Eesti Energia has increased by 28% during the year, in contrast, Latvenergo has increased by only 5%. It is important to mention that Latvenergo lost a significant part of its value due to reorganization, as the transfer of assets (regarding electricity transmission) to Augstsprieguma tīkls was started in 2019. Thus, most of the current value of Augstsprieguma tīkls (219 million euros) was transferred from Latvenergo to the company, allowing it to enter the TOP101 for the first time.

On the other hand, Latvenergo historically generated most electricity from renewable sources (hydropower), while Eesti Energia has made significant investments in the renewable electricity generation during the last 3-5 years only, for example, in 2018, wind farms in Estonia and Lithuania were purchased for 289 million euros.

Nowadays, green energy producers are highly valued by investors. This is determined by the policies of international organizations and countries that support climate-friendly solutions. And also the fact, that technology is rapidly evolving, and renewable energy is gradually becoming more profitable without any state subsidies.

A striking example is the relatively high price that investors paid for Lithuanian Iginitis Group IPO, largely caused by the company’s aggressive plans to invest in green energy (at the time of quotation the company value multiplier was 10.5). Latvenergo in its reports does not separately allocate EBITDA yet in a cross-section that allows green energy and fossil to be seen separately. If the makers of the TOP101 would have this kind of EBITDA break-down, it would probably allow to rate Latvenergo higher.

THREE DIFFERENCES

Why is the total value of Latvia's TOP101 21% smaller than Estonia's TOP101? This is greatly influenced by three factors.

First of them being profitability. The median EBITDA margin for Estonian companies is 28%, while for Latvian - 16%. The bigger the profit, the higher the value of the company.

The second is the structure of industries and different opinions of investors on the value of industries. Respectively, in Latvia the Enterprise value/the median EBITDA multiplier is 8, in Estonia it is 8.6 – this shows that in Estonia's TOP101 the sectors that are "more valuable" in the eyes of investors are represented more. Estonian real estate industry is very essential since it has a very high profitability.

The third is less direct, but also objective. Investors are more willing to pay for companies, if they are well-organized and transparent. The average corporate governance ratio in Latvia is 30, but in Estonia – 40 (the maximum being 100). In Latvia's TOP101 there are five companies listed on the exchange, while in Estonia there are eight such companies. Of course, there is room for improvement for both Estonian and Latvian companies.

In terms of industries, the interesting thing about Estonia is that real estate has taken the first place as the most valuable industry (previously ranked second). The share of this industry in the total value is almost 20%. In Latvian TOP101, this industry is insignificant – only 2.6%. That is peculiar because the differences in GDP are not that big. Such a difference was also observed in the previous year’s TOP101, but this year the gap has only increased. This could be explained by two conditions – larger real estate market development in Estonia over the last 5-10 years and the fact that in Estonia the market of big developers is significantly more concentrated. There are 26 (!) Estonian developers and only five Latvian in the TOP101.

In Latvian TOP101, the leader is the Trade: Consumer goods sector – 18.3% of the total value while in Estonia it does not even reach 5%. It is interesting that Latvian companies are ahead of Estonian in IT and telecommunications sector – 8.6% and 5.6% respectively. The difference would be even more significant if the most valuable player in the industry Mikrotīkls would have been included in Latvia 's TOP101, but unfortunately the company has not submitted the 2019 annual report to the SRS during the preparation period of TOP101 and was not included in the TOP101 for that reason.

Similar proportions in both countries TOP101 are represented by utilities services sector, as well as transport, transit and logistics.

What to expect in the future? I predict that technology, 5G availability and readiness of companies to introduce new technology solutions will have a significant impact on TOP101 structure as well as values in the near future, both in the private sector and state-owned enterprises.

Latvia definitely has opportunities to reduce value difference with the Estonian TOP101. This can be achieved by improving profitability indicators, and waiting for rapidly growing companies working in the global market (Printful, etc.) to qualify for entering the TOP101 next year. As well as the successful listing of Latvenergo or some other company on the exchange, where investors would determine a significantly higher value, would also help.

Published in "Ir Nauda" magazine, december, 2020