Rando Rannus, General Partner at Siena Secondary Fund

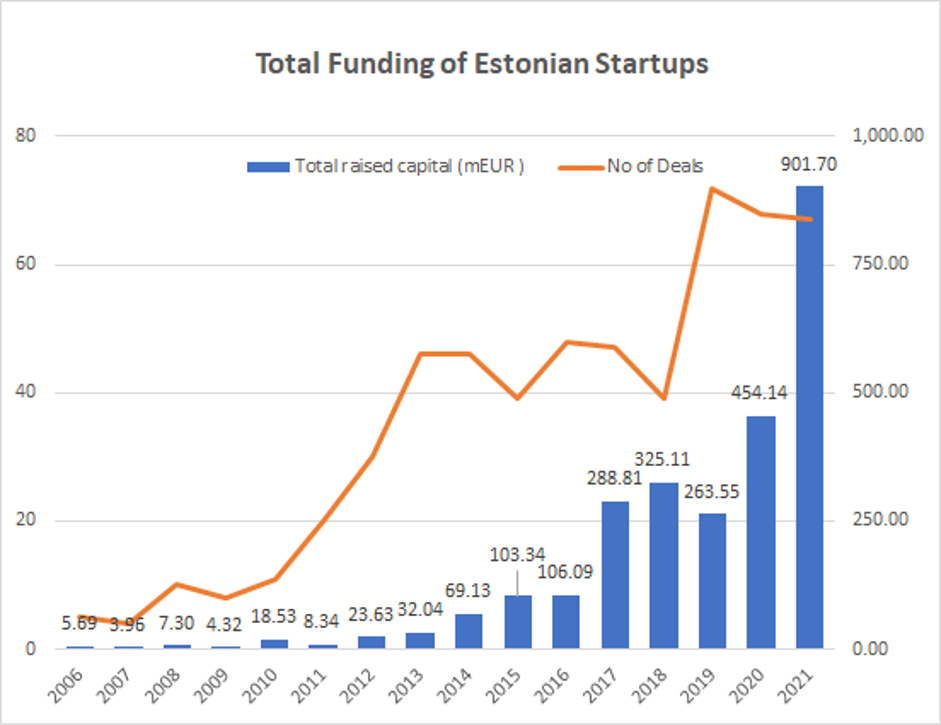

2021 has been a remarkable year for Estonia. The whole startup ecosystem has come out the pandemic much stronger than it was before - from one side Wise direct listing in London stock exchange as the first big liquidity event and from the other side having now 7 unicorns in a country of just over 1 million inhabitants, which puts us no 1 position of unicorns per capita in Europe and no 2 position in the world just after famous startup nation Israel. This has been topped by a massive influx of capital - Estonia is approaching this year's magical 1 billion EUR mark raised by our startups - which is more than 3% of Estonian GDP, just to put into context. Moreover, currently the market cap of the top25 technology companies in Estonia is close to 21 billion Euros (roughly 2x of Estonian state budget).

It is hard to believe that just a decade ago the total amount of startups was around 40 and capital raised in 2011 was only 8 million Euros - more than 100x less than in 2021. If Estonia has managed to grow its startup ecosystem so quickly, the question raises - where to go next? Estonian Founders Society has set a vision that by 2030 Estonia should have at least 30% of GDP coming from tech sector exports. This is an ambitious plan with assumptions that we just need to continue the growth rate that we have had in the past. The question is how this will be achieved - shall we have then 10x more unicorns than today or a small number of decacorns? What is the market cap of top technology companies in 2030?

In order to answer this question, let's look at the funding landscape and how this has changed over the last 10 years.

Data: Crowdsourced data by Estonian Founders Society - https://docs.google.com/spreadsheets/d/1csgtaNSl949AumfOBhwhD_S-o7wc1UIhKZdWUS4Vy-Q/edit#gid=5

One might ask, is this sustainable for the long run or is it just a bubble that will burst soon. The thing is that usually people tend to overestimate the short term trends and underestimate the long term trends. We assume that everything will happen in linear, but history never develops in linear, but exponentially. What if this is not a bubble, but the venture funding is just starting to grow exponentially?

If we assume that the funding will grow only 25% per year (vs so far Estonian startup funding has grown on average 72% per year), we would end up with more than 6 billion EUR raised in 2030 and close to 30 billion Euros for the whole decade from 2021-2030. Just for a comparison in 2011-2020 it was raised close to 1.7 billion Euros i.e. more than 17x increase in funding.If we assume that the funding will produce similar level of value in market capitalization then we should jump from 21 billion euros to more than 500 billion euros of market capitalization of the most valuable technology companies in Estonia. In order to achieve this it is quite evident that we will have extremely large technology companies whose value will pass the 100 billion euros mark - most likely there will be a couple of them. This is exactly what French president Emmanuel Macron has set a vision for European tech. Why not Estonia could be the one who will contribute a significant part to achieving this? Hard to believe? Will see this in years to come.